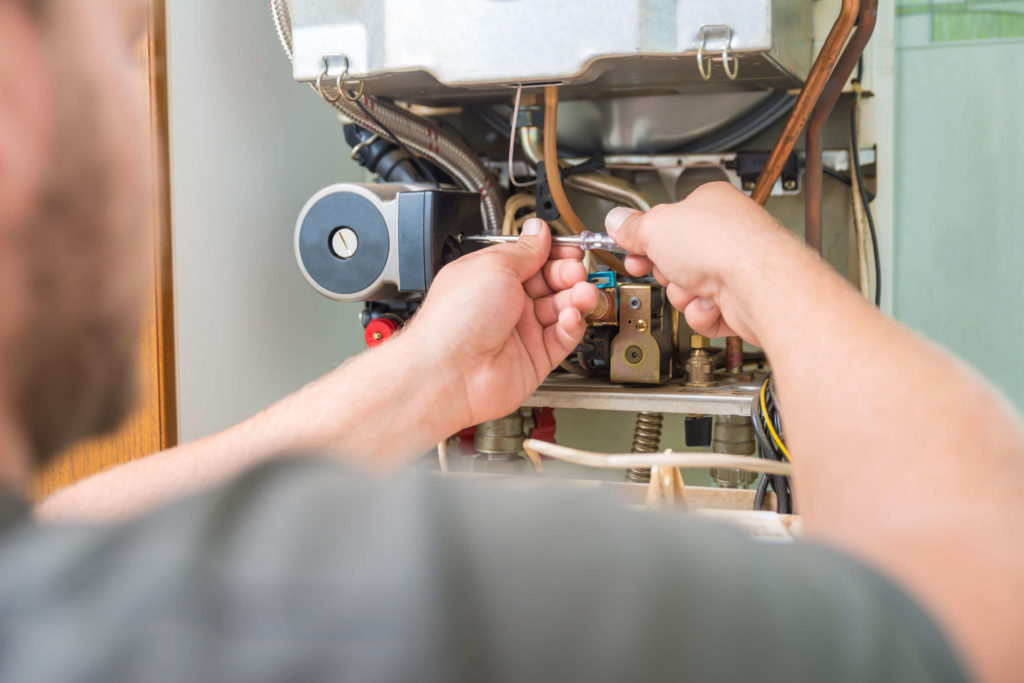

How HVAC System Upgrades Saves Money And Energy

Upgrading your Nashville HVAC system can lead to a variety of money and energy savings.

These upgrades can come with rebates or other incentives when homeowners opt for eco-friendly systems.

Six Energy-Efficient Upgrades For Charlotte Residents

There are a few ways that Nashville homeowners can upgrade their HVAC systems to generate more energy efficiency.

Below are six energy-efficient HVAC upgrades that come with tax credit benefits.

- Geothermal heat pumps

- Natural gas, propane, and oil furnaces

- Air source heat pumps

- Central air conditioners

Everything listed above is heating, ventilation, and air conditioning system upgrades that qualify for tax credits beginning in 2023.

For energy reduction tips and a consultation contact MJfrickco today!

Geothermal Heat Pumps For 30% Off

Geothermal Heat Pumps

Geothermal heat pumps are just one of the energy-efficient ways to upgrade your system.

These systems use heat sourced from the ground and are considered the most energy-efficient system available.

The heat taken from the ground is transferred back and forth between your home and the ground.

The season will depend on which direction the heat goes.

Installation of these pumps is a bit involved and can be costly, ranging from $10,000 to $30,000.

However, because of The Inflation Reduction Act, homeowners are eligible to receive a tax credit for up to 30% of the cost.

For more information regarding your geothermal heat pump contact our company today!

Natural Gas, Propane, and Oil Furnaces

Natural gas, propane, and oil furnaces that are ENERGY STAR certified can qualify for a tax deduction. The deduction is 30% of the cost of the project.

Natural gas is the cheapest and most energy-efficient way to heat a home.

Air Source Heat Pumps

Air source heat pumps are not only energy efficient, they are also environmentally friendly.

Heat pumps do not burn fuel to operate; they take heat from the outside and warm the inside of the home during the winter months.

These heat pumps qualify for a tax credit because they have a lower carbon footprint when compared to other systems. The tax credit for these heat pumps is 30%, up to $2000.

To switch over to a more environmentally friendly supply of hot air contact MJ Frick now!

Central Air Conditioners

Homeowners who install central air conditioners can also receive a 30% deduction.

It’s important to note that rental properties and new construction do not qualify for this tax credit.

Energy Star packaged systems are eligible for this credit, whereas split systems with a rating of SEER2 > 16 is eligible.

For more information contact MJ Frick today!